DOWNERS GROVE, Ill., July 24, 2025 /PRNewswire/ — Dover (NYSE: DOV), a diversified global manufacturer, announced its financial results for the second quarter ended June 30, 2025. All comparisons are to the comparable period of the prior fiscal year, unless otherwise noted.

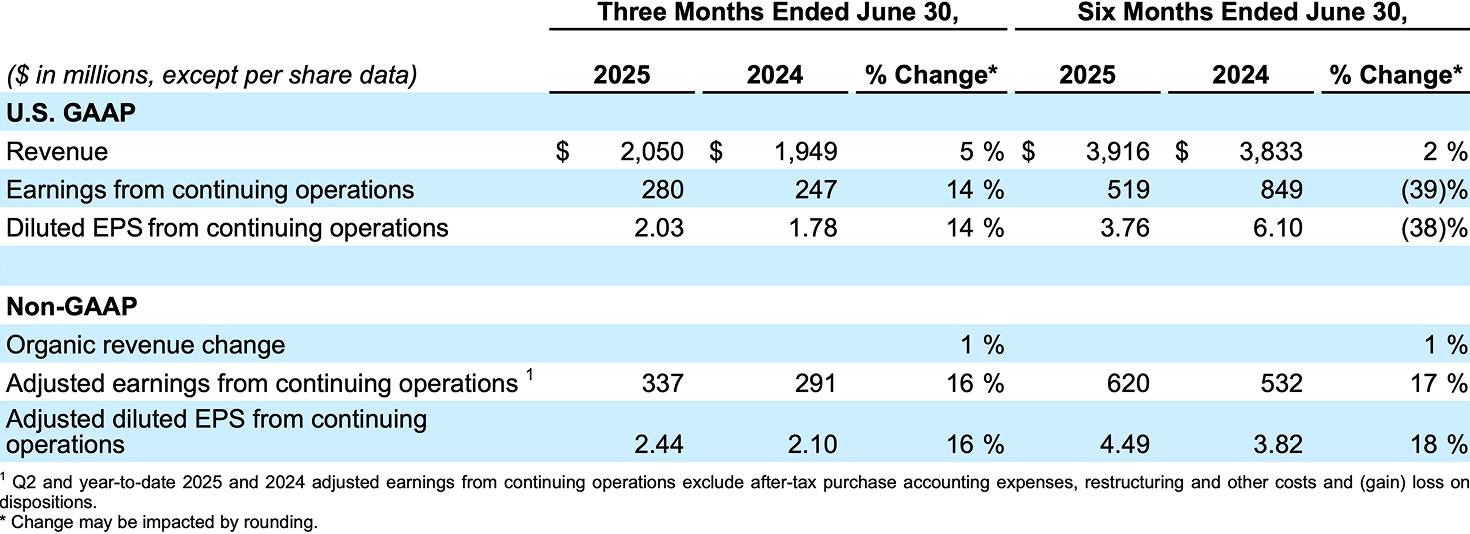

For the quarter ended June 30, 2025, Dover generated revenue of $2.0 billion, an increase of 5% (+1% organic). GAAP earnings from continuing operations of $280 million increased 14%, and GAAP diluted EPS from continuing operations of $2.03 was up 14%. On an adjusted basis, earnings from continuing operations of $337 million were up 16% and adjusted diluted EPS from continuing operations of $2.44 was up 16%.

For the six months ended June 30, 2025, Dover generated revenue of $3.9 billion, an increase of 2% (+1% organic). GAAP earnings from continuing operations of $519 million decreased by 39%, and GAAP diluted EPS from continuing operations of $3.76 was down 38%, both principally due to the gain on the disposition of De-Sta-Co in the comparable period of the prior year. On an adjusted basis, earnings from continuing operations of $620 million increased 17%, and adjusted diluted EPS from continuing operations of $4.49 was up 18%.

A full reconciliation between GAAP and adjusted measures and definitions of non-GAAP and other performance measures are included as an exhibit herein.

MANAGEMENT COMMENTARY:

Dover's President and Chief Executive Officer, Richard J. Tobin, said, "Dover’s second quarter results were solid, driven by excellent production performance and execution in the face of a highly dynamic global trading environment.

"Top line performance accelerated in the quarter on broad-based shipment growth in short cycle components and continued strength in our secular-growth-exposed end markets. Order trends continued to post positive momentum in the quarter, bolstering our confidence in the second half outlook with a majority of our third quarter revenue already in the backlog. Margin performance in the quarter was exemplary with a record consolidated segment margin, a result of prior portfolio actions, positive mix impact from our growth platforms, and our rigorous cost containment and productivity actions.

"Our solid operational results were complemented by ongoing capital deployment actions. We continue to invest in high-ROI organic capital projects, including productivity and capacity expansions as well as targeted footprint optimization. During the quarter we also completed two acquisitions of attractive, fast-growing assets within our high-priority Pumps & Process Solutions segment. Our balance sheet strength remains an advantage that provides flexibility as we pursue value-creating capital deployment to further expand our businesses in high growth, high margin areas.

"We are approaching the second half of 2025 constructively. Despite some macroeconomic noise, underlying end market demand is healthy and is supported by our sustained order rates. As a result of our first half performance, we are increasing our full year adjusted EPS guidance from $9.20-$9.40 to $9.35-$9.55."

FULL YEAR 2025 GUIDANCE:

In 2025, Dover expects to generate GAAP EPS from continuing operations in the range of $8.00 to $8.20 (adjusted EPS from continuing operations of $9.35 to $9.55), based on full year revenue growth of 4% to 6%.

CONFERENCE CALL INFORMATION:

Dover will host a webcast and conference call to discuss its second quarter results at 9:30 A.M. Eastern Time (8:30 A.M. Central Time) on Thursday, July 24, 2025. The webcast can be accessed on the Dover website at dovercorporation.com. The conference call will also be made available for replay on the website. Additional information on Dover's results and its operating segments can be found on the Company's website.

ABOUT DOVER:

Dover is a diversified global manufacturer and solutions provider with annual revenue of over $7 billion. We deliver innovative equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services through five operating segments: Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions and Climate & Sustainability Technologies. Dover combines global scale with operational agility to lead the markets we serve. Recognized for our entrepreneurial approach for over 70 years, our team of approximately 24,000 employees takes an ownership mindset, collaborating with customers to redefine what's possible. Headquartered in Downers Grove, Illinois, Dover trades on the New York Stock Exchange under "DOV."

FORWARD-LOOKING STATEMENTS:

This press release contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements in this document other than statements of historical fact are statements that are, or could be deemed, "forward-looking" statements. Forward-looking statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond the Company's control. Factors that could cause actual results to differ materially from current expectations include, among other things, general economic conditions and conditions in the particular markets in which we operate; supply chain constraints and labor shortages that could result in production stoppages; inflation in material input costs and freight logistics; the impacts of natural or human-induced disasters, acts of war, terrorism, international conflicts, and public health crises on the global economy and on our customers, suppliers, employees, business and cash flows; changes in customer demand and capital spending; competitive factors and pricing pressures; our ability to develop and launch new products in a cost-effective manner; changes in law, including the effect of tax laws and developments with respect to trade policy and tariffs; our ability to identify, consummate and successfully integrate and realize synergies from newly acquired businesses; acquisition valuation levels; the impact of interest rate and currency exchange rate fluctuations; capital allocation plans and changes in those plans, including with respect to dividends, share repurchases, investments in research and development, capital expenditures and acquisitions; our ability to effectively deploy capital resulting from dispositions; our ability to derive expected benefits from restructurings, productivity initiatives and other cost reduction actions; the impact of legal compliance risks and litigation, including with respect to product quality and safety, cybersecurity and privacy; and our ability to capture and protect intellectual property rights. For details on the risks and uncertainties that could cause our results to differ materially from the forward-looking statements contained herein, we refer you to the documents we file with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2024, and our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These documents are available from the Securities and Exchange Commission, and on our website, dovercorporation.com. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.